EE expands its next-gen 5G network – is your phone already ready for it?

EE’s newer and faster 5G network is expanding to even more areas in the UK, and your smartphone probably already supports it

EE’s newer and faster 5G network is expanding to even more areas in the UK, and your smartphone probably already supports it

You can bag the Sony KD-50X75WL 4K TV with £130 in savings thanks to this limited-time promotion from EE with its latest Deal Drop

Samsung’s affordable Tab S10 FE only launched last month but EE has already discounted it to its lowest price ever – £349

You can bag the Beats Studio Pro over-ear headphones for £149 in this EE deal, and you don’t even need to be an existing customer!

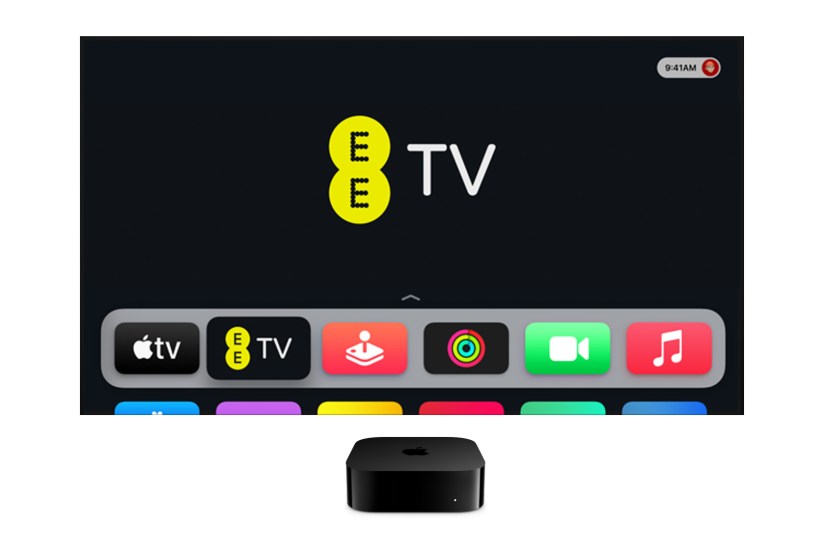

EE’s Black Friday deals are here with huge savings on broadband and EE TV

EE is teaming up with Qualcomm on a new Wi-Fi 7 router you can get right now – it promises 1.6Gbps speeds and 100Mbps minimum in every room

This EE deal lets you bag the PlayStation Portal, a subscription PlayStation Plus Extra, and all the data you need to play

The deal lets you pay for the game and a brand new console with a monthly plan from EE, letting you save big from the RRP

You could nab yourself a new smartphone on EE for less, thanks to these top deals on pay monthly contracts.

EE is also launching a new platform where you can buy third-party services, and its 1.6Gbps broadband service is now available.

Exceedingly fast speeds with new routers to deliver them.

EE does TV as well – and you can watch Freeview and various streaming services on the platform